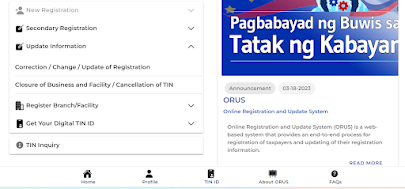

Guide for self-employed individual taxpayers on how to avail the 8% Income Tax Rate Option thru ORUS Online Registration and Update System

Log in to your ORUS Account

Click Secondary Registration

Click Correction/Change/Update of Information

Information to Update

Tick Avail 8% Income Tax Rate Option

Click Ok

Agree to all terms and conditions

Congratulations!

Guide for Taxpayers who availed 8% Income Tax Rate thru ORUS Online Registration and Update System

Tax Types

Quarterly Income Tax BIR Form 1701Q

Annual Income Tax BIR Form 1701A

Quarterly Income Tax for the year 2024

BIR Form 1701Q

First Quarter (January to March, 2024) - deadline May 15, 2024

https://youtu.be/YVtTfxcmA84

(Sample just change the year to 2024)

Second Quarter (April to June) - deadline August 15, 2024

https://youtu.be/hlhKJdPIq9o

Third Quarter (July to September) - deadline November 15, 2024

https://youtu.be/HXIvPZJRCsw

No Fourth Quarter 1701Q

Annual Income Tax Return

Bir Form 1701A

January 1 to December 31, 2024 - deadline April 15, 2025

Sample Video Annual Income Tax for the year 2023:

https://youtu.be/Fv-X2qgbCAA

No comments:

Post a Comment